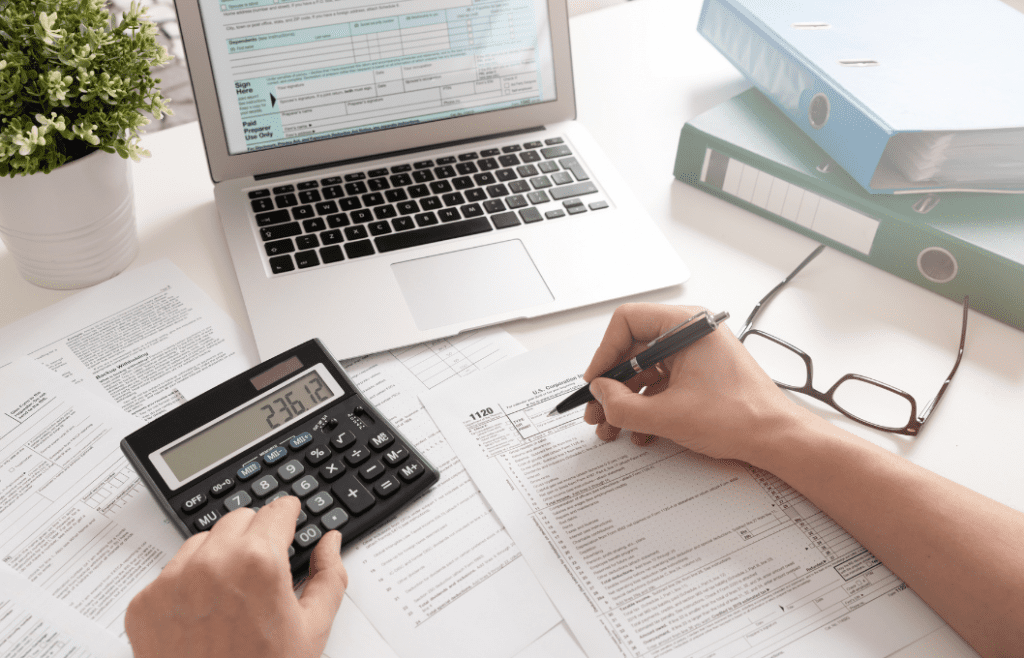

2020 was a year full of surprises and pivots for entrepreneurs. But we don’t want you to be be surprised on your taxes.

So we partnered with fellow military spouse Sonia Rosa, CPA to help unpack the best practices and important things to consider as you file your business taxes this year.

*Don’t forget the deadline to file business tax returns is March 15th!

Working From Home

Do you have a dedicated office space? Did you know that it can be a used as a deduction? As long as your office is a separate room that is only used for business purposes, you can calculate the percentage of that room compared to the total square feet in your house, and that percentage tells you how much of your rent or homeowner expenses (mortgage insurance, taxes, homeowner insurance, utilities, and repairs) you can deduct.

Do you use your home internet or personal cell phone for business purposes? The same principal applies! Calculate what usage percentage is for your company, and you can deduct that same percentage of the total bill.

Also be sure to think if you’re buying supplies (such as a printer, computer, pencils, paper, etc.). How much do you use them in your business vs. family use? What about driving – do you often drive to the post office to mail products? Do you deliver good or services in your personal vehicle? How often do you go out to buy supplies? The same concept of calculating a percentage applies here too.

Moving Your Business to Another State

Did you PCS in 2020? Did you move your business operations to the new state? You’ll likely need to file in any state you conducted business for that year. You’ll also need to account for any change in sales tax in your new state.

Do your business operations include large equipment or anything that would significantly add to the total weight of your household goods? Military spouses are eligible to have up to 500lbs of Professional Books, Paper, and Equipment (PBP&E – aka “Pro Gear”), which is anything that is needed for employment or community support activities. You’ll need to declare this prior to moving and have it approved by the local Personal Property Office. This is a separate weight allowance from the service member, who is entitled to “Pro Gear” with an increased weight limit of 2,000 pounds.

Pandemic-Related Small Business Assistance

Did you receive financial assistance for your business? You might be liable for taxes on that income. There were many different types of assistance from loans to grants and everywhere in between. Be sure to know whether the assistance you received was tax-free or not.

Did you receive assistance from the CARES Act or the PPP? The Paycheck Protection Program (PPP) rolled out in 2020 under the Coronavirus, Aid, Relief, and Economic Security (CARES) Act as an emergency loan for small businesses directly impacted by the economic decline of the pandemic. But this is a forgivable loan for most, as long as you used the funds for payroll, rent/mortgage, or utilities. Any amount of the loan that was forgiven is not taxable. However, any amount of the loan that is not forgiven is taxable income. There were many other relief programs for businesses during 2020, and you can read more about them and their tax implications here.

Tips and Best Practices

How many subscriptions do you have? If you’re like me, I love to simplify and streamline. But it’s easy to pay for more than you need. Software systems are constantly rolling out new updates, and maybe the reasons you have a few could now be rolled into one with the recent addition of new features. At least once a year, take a look at all your subscriptions. See what features have been added and look at what you really use vs. what you really need. Oftentimes, this is an easy way to cut expenses from your budget.

Do you have a separate bank account for your business? The biggest advice Sonia offers is to ensure your business accounts and personal accounts are separate. Even if you’re a one-person team selling crafts as a side-hustle, get a dedicated business account. It will make doing your taxes and budget so much easier and give you a clear view into the financial health of your business.

Our best advice?

Get yourself a tax pro. Taxes are complicated, and with the financial impact and complexities surrounding the pandemic, having someone who knows tax laws inside and out is priceless.

As a fellow military spouse owned business, we love working with Sonia Rosa on our taxes and financial needs.

But beyond tax prep and planning, Sonia also provides CFO services that oversee your current booking and give you business forecasts, metrics, and financial reporting. She will even help you set-up a new accounting system. As business owners, we owe it to our clients and customers (and ourselves!) to let someone else ensure our financial health so we can focus on providing the best products and services.

Have more questions?

Even if you do the research, some answers will just depend on your situation. You can book a discovery call with Sonia here to ask your specific questions!